RITA℠ ALERTS, NEWS, AND INSIGHTS

Within the Financial Services Marketplace, The Best Help for Individual Investors Is Often Self-Help.

Rita℠ provides you investment-related information previously only available to professionals to individual investors. This information can help you to protect yourself from "Marketplace Risk" and to make sound investment decisions.

Want to Know How Good Your Mutual Funds REALLY Are? Here’s How You Can Now Find Out.

Learn What the Investment Reports You’re Getting Aren’t Showing You and Why This Information Has Always Been Withheld from Investors.

Your brokerage statements and investment advisor-produced reports show how much your mutual funds and/or ETFs went up or down and typically give you a benchmark index (hopefully relevant) with which to gauge how well yours did. But is that enough to tell you how well your funds really performed? NO. Something very important has always been missing.

To know how good (or not so good) your mutual funds and ETFs really are, you need to know not just how your investment choices did compared to an index. You need an answer to this key question: “How did my choices do compared to all of the others I could have selected?” Isn't that what truly matters? That’s what you really need to know, and that’s what’s been missing.

Without that information, you have no way to know how good the investment choices that you’re making actually are. You may be investing in poor performing funds, holding poor performers too long, and likely be getting poorer investment results than you otherwise could. But you would never know.

Surprisingly, few (if any) investors are asking that question. Having never seen such comparisons, they may mistakenly assume that it’s not possible to answer it. But it is. The truth is that this important information is being deliberately kept from you. Why?

The answer is pretty simple. The financial services marketplace has been vendor-dominated since inception. What vendor or distributor of mutual funds, ETFs, or other financial products would want you to have a way to compare theirs against all other available choices? Why would any of them want to risk you finding other choices better for you than theirs or the ones they’re recommending? Obviously, they wouldn’t. They don't want you to have the power to make informed investment decisions on your own.

Limiting your ability to compare your choices (or what’s being recommended and sold to you) solely to a benchmark effectively keeps investors (you) blind to other choices that could be better, possibly a lot better. It helps to preserves and perpetuate financial industry power in a way that keeps investors (you) dis-empowered and dependent, too often investing in inferior choices and missing out on investment returns that you’ll never be able to calculate and that could have improved your life.

Strangely, until now, no one (not even regulators) appear to be seriously questioning any of this. This issue appears to be largely unrecognized. It’s as though the limited information you and every other investor is getting today is simply accepted, without question, as “just the way it is” and “that’s all investors need.”

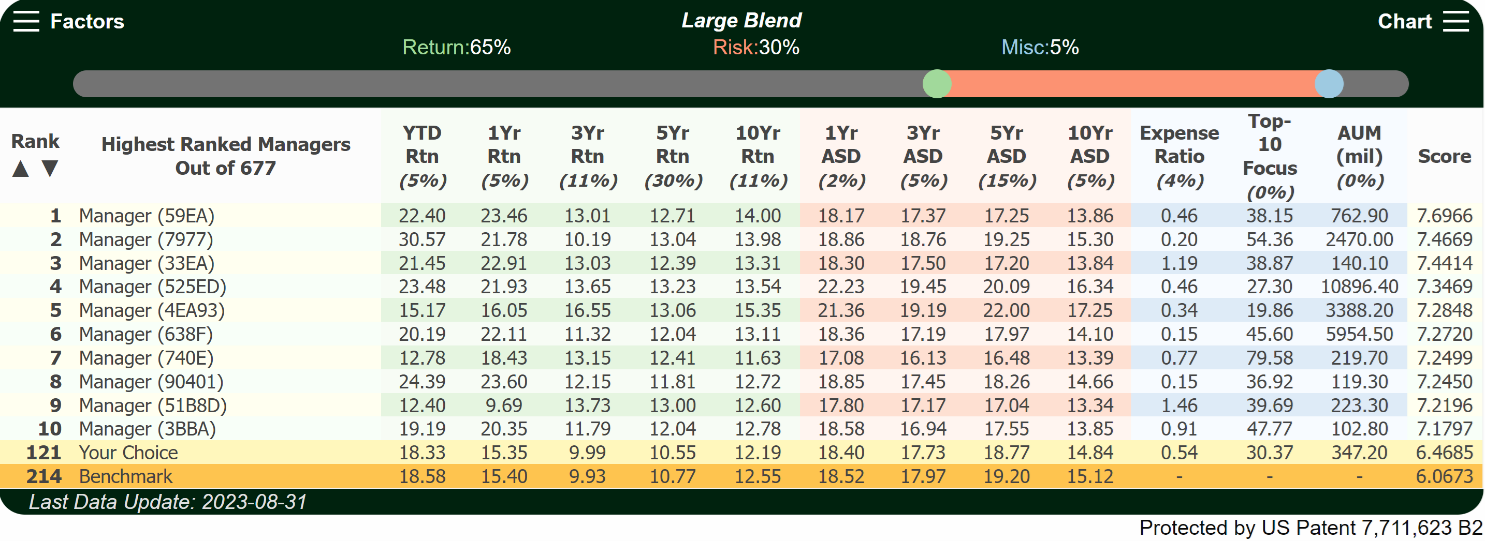

Fortunately, there’s now a way for you to independently perform such comparisons, answer the above key question, and help to improve your investment results, possibly dramatically. Using the free version of the newly released Retail Investment Tracking Application℠ (“Rita℠”), we performed a comparison of the performance of one of many S&P 500 Index Fund choices against 677 similar mutual funds and ETFs making up the “Large Cap Blend” asset class. The result is shown in the table, below. The S&P 500 Index fund is highlighted in yellow. The benchmark index (the Russell 1000) is highlighted in orange. The free version (used here) doesn’t show the names of the mutual funds and ETFs. The paid / full version does.

Using 15 factors (of 24 available), 13 of which were weighted as shown, the resulting score ranks the choices from 1 (the highest score) to 677 (the lowest). Using this blend of weighted factors, the S&P 500 choice ranked 121. Importantly, you can control the factors selected and the weights applied to them to best match your needs, goals, and preferences. You can experiment with various arrangements of factors and weights as much as you like to figure out what you think is best for you. BTW – this comparison took less than 5 minutes to perform.

Individual investors have never seen anything like this. All they (you) ever get to see, in quarterly reviews and brokerage statements, is a comparison of what you have vs. a benchmark – in this case # 121 (the ETF) vs. #214 (the benchmark index). And if #121 had beat the returns of the benchmark (#214) in every reported period (which it didn’t in this case), what would an advisor likely tell you? It would likely be something like this: “Looks like we’re doing great – no need to change.”

However, you would not be aware that (using the factors and weightings shown) there are 120 choices with higher scores that might be better choices. Certainly the #1 ranked choice looks dramatically better (averaging returns of nearly 2% more per year, for 10 years, with less volatility and less cost). Ironically, the investment advisor would also not be aware of this. Without the benefit of this newly available technology (there’s now a professional version for advisors), he or she would as much “in the dark” as his or her client.

Rita℠ provides individual investors (you) with both complete “transparency” and “control.” It enables you to score and rank all available mutual funds and ETFs within any covered asset class, in mere moments, and in a way that effectively filters out all conflicts of interest. Seeing all available choices and the factors used in comparatively evaluating them; that’s transparency. Being able to select and weight the factors in ways that match your unique needs, goals, and preferences, so you can identify those that have proven best over time at producing the investment effects you’re ideally seeking; that’s control.

The Rita℠ website – https://sayrita.com – contains a growing body of “how to” information, as well as news and commentary – information often available only to investment professionals. It provides actionable information that could help you to improve your investment results, perhaps dramatically. You can try Rita℠ free of cost or obligation (no credit card required) by going here.

Using it, you can quickly see how good your mutual funds and ETFs REALLY are in comparison to others in which you could be investing. And, if you have a broker or investment advisor, you can quickly see just how good their investment choice recommendations (and/or the investment choices available in your own 401k plan) REALLY are. You should try it and see for yourself just how much money you may have been, and perhaps still are, “leaving on the table” by being in poor performing choices that you’ve had no meaningful way, until now, to comparatively evaluate. It’s time to change things – it’s time for you to take control.

“I would highly encourage and recommend that average investors take a look at this great technology . . . I’ve never seen anything like it."

Joe H.

“As a friend of the creators of Rita, I’ve watched this game-changing technology evolve over many years to a point where I can say, yet again, “you have to see it to believe it.”

Mark L.

"RITA is the greatest decision assistance technological invention of our time. This will change the way we invest forever."

Kay K.

Why Rita℠?

Worried about picking the right mutual funds and ETFs for your investment portfolio or your IRA or 401(k)? Rita℠ is the solution. Rita℠ is the only Retail Investment Tracking Application℠ that quickly and easily answers this key question: "Of all the available choices of mutual funds and ETFs, which ones are best for me? With Rita℠, you can feel confident that you're picking the best mutual fund and choices for your future. Stop guessing what's best for you - let Rita℠ do all the hard work!

“I've witnessed first-hand dozens of demonstrations of "RITA" to friends I’ve introduced. What's remarkable is when a person sees how much money he or she has not gotten over multiple years, they’re shocked. It shows them how much better they could be doing with this revolutionary investment tool.”

Robert S.

“This technology a game changer for individual investors. . . a major breakthrough. Investors will now be able to see how much money they’re leaving on the table, and the information obtained from Rita is actionable.”

Albert M.

Any investing-related information provided on sayrita.com is for educational purposes only. Decision Technologies Corporation does not offer investment advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular mutual funds, ETFs, or other investments.

<a rel="me" href="https://mastodon.social/@sayrita">Mastodon</a>

© Copyright 2025. Rita℠ by Decision Technologies Corporation. All rights reserved