RITA℠ ALERTS, NEWS, AND INSIGHTS

Within the Financial Services Marketplace, The Best Help for Individual Investors Is Often Self-Help.

Rita℠ provides you investment-related information previously only available to professionals to individual investors. This information can help you to protect yourself from "Marketplace Risk" and to make sound investment decisions.

The Unseen Costs of ESG Fund Investing

The “opportunity cost” of selecting ESG funds may be more than you imagine. Here’s how to find that out.

ESG (Environmental, Social, and Governance) focused investment funds and ETFs represent a shift from performance-based investment selection to what can be described as a “good intentions” selection model.

“I want my investments to align with my ‘values’. I want to invest in funds and companies that are doing ‘good,’ and want to feel good about doing so.”

Is there anything wrong with wanting to feel good about your investments?

NO.

But how do you know if what you are hoping to accomplish is factually real / true?

How deep have you gone to find out?

Additionally, do you know how much in potential investment performance you are sacrificing to these investments in that way?

These are all serious questions, made ever more serious by the fact that there has been little way for investors to know whether the representations of the ESG-labeled funds (and the companies they are investing in) are true. So, pervasive is this issue that a new word has been created to describe it:

“Greenwashing.”

For this and other reasons, we’re now seeing a growing de-emphasis, if not outright rejection, of ESG. But, although Greenwashing can hurt individual investors by preventing their ESG-focused investment goals from being realized, the problem is significantly greater.

Until Rita℠, investors have had no easy way to comparatively evaluate the performance of ESG funds against all others they could have selected.

Here’s an example:

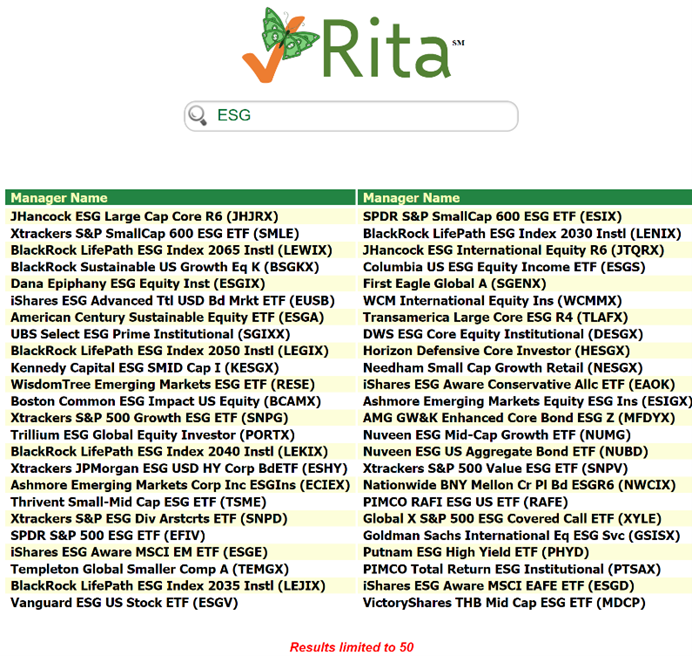

When you log into Rita℠ (try the free “Checkup” version for this example) you can simply type “ESG” into the entry line, as shown.

What you will instantly see is a listing of all types of ESG funds, in virtually every asset class.

There are a lot of them – not just the 50 shown.

We simply picked one in the “Large Blend” asset class - an allocation that almost all investors have in their portfolios. You can pick any of them or log in your own to test what we’re saying.

What is so important about Rita℠ is that it enables you to comparatively evaluate any ESG fund - not just to a “Benchmark Index,” but to every other fund within that asset class.

In that way, you get to see something no one has ever been able to show you – how much performance you would have given up (if any) by having invested in that ESG fund . . . in other words, the opportunity cost (if any) associated with that ESG investment.

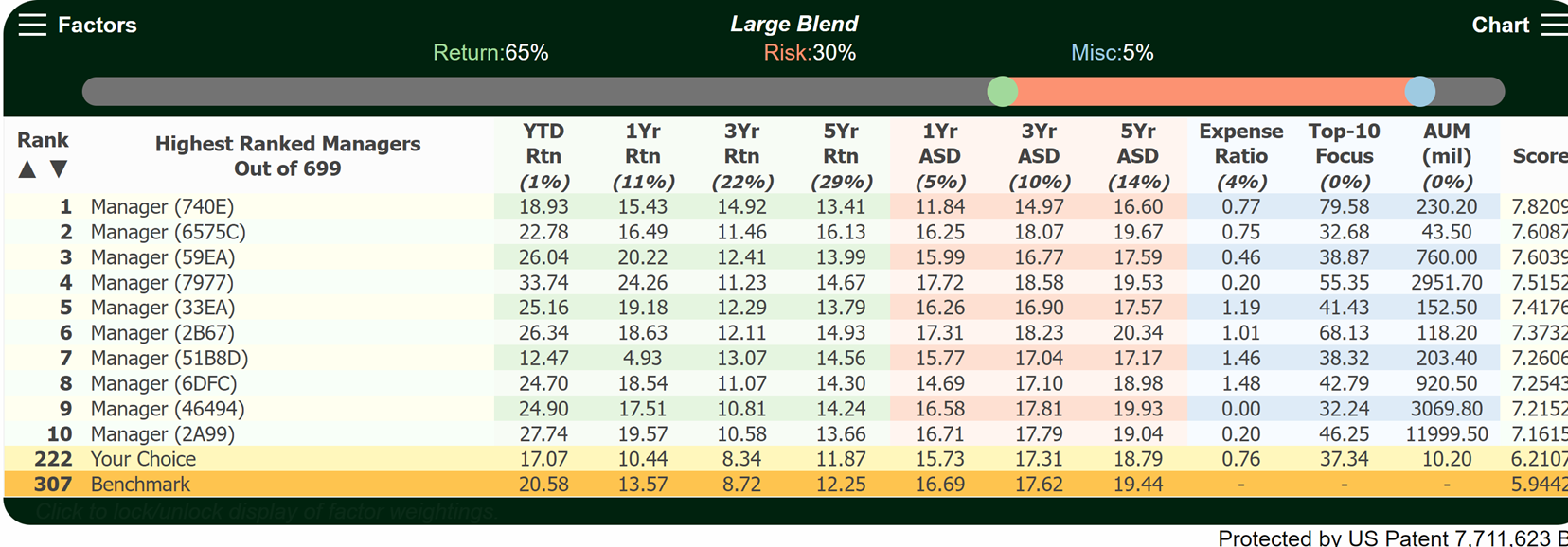

Here’s the result, using the free Checkup version of Rita℠:

Notice that the ESG fund that we randomly selected is shown in “yellow” and ranks 222 out of a total of 699 choices.

Is it the “best?”

NO. But it’s not the worst either.

It scored and ranked within the top third. But the results certainly look disappointing.

When compared to the Benchmark (in orange), its average annual returns under-performed in every reported period: YTD (Year to date), 1-Year, 3-Years, and 5-years. It was very slightly less volatile (“ASD” is a measure of volatility, so a lower number is generally considered better).

But performance against a benchmark index is not what we would ideally wish to see. We already get that in brokerage statements and investment reports.

The more meaningful question is how did it perform against all of the other choices?

Take a look at #4, the performance of which I happen to like. You don’t always have to pick the top scoring fund.

The performance gaps are shockingly large: over 16% YTD, nearly 14% over the last year, nearly 3% per year for both 3 years and 5 years. It is slightly more volatile than the ESG fund (but not more than the Index), and #4 costs (at 20 bps) over 3 times less than the ESG fund (at 76 bps). Plus, there’s not a lot of investment dollars in the ESG fund, raising questions about it’s “sustainability” . . . will they be able to keep the fund operational.

The bottom line is this: Rita℠ gives you information never before available to help you make better-informed investment decisions.

With this new information in hand, if you want to still invest in this or any other ESG fund, no problem. You have the right and should have the ability to invest in anything you choose.

However, Rita℠ will let you see how much money those who invested in that ESG fund may have “left on the table” by being in it, so you can more clearly decide for yourself if it’s worth it to you. It very well could be.

Between this new comparative performance information and Greenwashing concerns, some investors wonder “is there any alternative . . . any way to ensure that I don’t unnecessarily sacrifice too much in investment returns and still accomplish my ESG goals?”

The answer may well be “YES.”

Here’s a suggestion:

Pick a good performing fund and, using Rita℠, calculate the performance gaps that you see between it and the ESG fund(s) you would have invested in.

Then give that amount (likely tax deductible) to the non-profit, ESG-related “cause” of your choice.

“I would highly encourage and recommend that average investors take a look at this great technology . . . I’ve never seen anything like it."

Joe H.

“As a friend of the creators of Rita, I’ve watched this game-changing technology evolve over many years to a point where I can say, yet again, “you have to see it to believe it.”

Mark L.

"RITA is the greatest decision assistance technological invention of our time. This will change the way we invest forever."

Kay K.

Why Rita℠?

Worried about picking the right mutual funds and ETFs for your investment portfolio or your IRA or 401(k)? Rita℠ is the solution. Rita℠ is the only Retail Investment Tracking Application℠ that quickly and easily answers this key question: "Of all the available choices of mutual funds and ETFs, which ones are best for me? With Rita℠, you can feel confident that you're picking the best mutual fund and choices for your future. Stop guessing what's best for you - let Rita℠ do all the hard work!

“I've witnessed first-hand dozens of demonstrations of "RITA" to friends I’ve introduced. What's remarkable is when a person sees how much money he or she has not gotten over multiple years, they’re shocked. It shows them how much better they could be doing with this revolutionary investment tool.”

Robert S.

“This technology a game changer for individual investors. . . a major breakthrough. Investors will now be able to see how much money they’re leaving on the table, and the information obtained from Rita is actionable.”

Albert M.

Any investing-related information provided on sayrita.com is for educational purposes only. Decision Technologies Corporation does not offer investment advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular mutual funds, ETFs, or other investments.

<a rel="me" href="https://mastodon.social/@sayrita">Mastodon</a>

© Copyright 2025. Rita℠ by Decision Technologies Corporation. All rights reserved